We’ve all heard about 2-step/factor verification methods for some time. It helps protect against fraud by requiring an additional layer of authentication such as text message or email in order to access or change your account information. As this practice becomes more widespread, how many of us have taken the time to set up this security protocol on each site that offers it? Who wants to look at yet another device/email/text message just to access one of their accounts? Now imagine that you are logged into your online Quickbooks account one day… You can see the details of your account on your computer screen as you organize papers on your desk. Out of the corner of your eye, you notice your mouse moving across your screen… WITHOUT YOU TOUCHING IT! As you watch in horror, the mouse adds a vendor. A payee you have never heard before. Your phantom mouse then begins issuing a check to this mystery vendor-from YOUR checking account. This may sound far fetched, but it recently happened to one of our clients. Although they were able to get their money returned, we have now learned that it could have been prevented by utilizing Quickbooks’ 2-step verification option. We highly recommend utilizing 2-step verification methods on any websites that offer them. This added layer of security is vital to keeping your information private and secure. To make the process a little easier, some sites offer an option to “remember your device”. This will eliminate the need to re-verify your device on the next log in. So next time you are asked if you would like to set up a 2-step verification process, ask yourself, how much money could those 5 minutes of your time really be worth?

0 Comments

CMS is proposing changes to address the widening gap in health equity highlighted by the COVID-19 Public Health Emergency (PHE) and to expand patient access to comprehensive care, especially in underserved populations. In CMS’s annual Physician Fee Schedule (PFS) proposed rule, the agency is recommending steps that continue the Biden-Harris Administration’s commitment to strengthen and build upon Medicare by promoting health equity; expanding access to services furnished via telehealth and other telecommunications technologies for behavioral health care; enhancing diabetes prevention programs; and further improving CMS’s quality programs to ensure quality care for Medicare beneficiaries and to create equal opportunities for physicians in both small and large clinical practices.

According to Wikipedia, bad debt is defined as - Bad debt occasionally called Uncollectible accounts expense is a monetary amount owed to a creditor that is unlikely to be paid and for which the creditor is not willing to take action to collect for various reasons. In financial accounting and finance, bad debt is the portion of receivables that can no longer be collected, typically from accounts receivable or loans. Bad debt in accounting is considered an expense. In healthcare there are several determining factors that will determine the amount of bad debt that is incurred in a practice. It comes down to the revenue cycle of the claim and how well the provider and the billing company work together to keep an eye on the entire work flow process. I have read that the industry average for bad debt should be between 3-5% of the total adjustments. There are Contractual adjustments vs non contractual adjustments (untimely claims filing, failure to obtain a prior authorization, etc). The non contractual ones should be analyzed and reviewed monthly, quarterly and yearly to determine where the holes are and what improvements can be made. Most software systems can provide a report that shows the specific reasons a balance is not paid. The percentage of patients who are uninsured has been increasing of late, due to recent job losses: According to the Kaiser Family Foundation, about 27 million Americans will have lost their employer-sponsored insurance as a direct result of the pandemic. Patient portions are on the rise which can increase the amount of bad debt write offs. Here are some steps to follow if your bad debt is on the patient side:

We are often asked if it is ok to either not bill Medicare for a service provided to a patient or to bill the patient instead ? Great questions with a lot of guidelines. The Advance Beneficiary Notice of Noncoverage (ABN), Form CMS-R-131, is issued by providers (including independent laboratories, home health agencies, and hospices), physicians, practitioners, and suppliers to Original Medicare (fee for service - FFS) beneficiaries in situations where Medicare payment is expected to be denied. The ABN is issued in order to transfer potential financial liability to the Medicare beneficiary in certain instances. Guidelines for issuing the ABN can be found beginning in Section 50 in the Medicare Claims Processing Manual, 100-4, Chapter 30 (PDF). An ABN form is available by CMS at the link attached. The form is subject to public comment and re-approval every 3 years so having the most recent version is very important. There are tutorials, instructions, and forms in both English and Spanish for your use. The ABN must be reviewed with the beneficiary or his/her representative and any questions raised during that review must be answered before it is signed. The ABN must be delivered far enough in advance that the beneficiary or representative has time to consider the options and make an informed choice. Employees or subcontractors of the notifier may deliver the ABN. ABNs are never required in emergency or urgent care situations. Once all blanks are completed and the form is signed, a copy is given to the beneficiary or representative. In all cases, the notifier must retain a copy of the ABN delivered to the beneficiary on file. The ABN may also be used to provide notification of financial liability for items or services that Medicare never covers. When the ABN is used in this way, it is not necessary for the beneficiary to choose an option box or sign the notice. CMS has issued detailed instructions on the use of the ABN in its on-line Medicare Claims Processing Manual (MCPM), Publication 100-04, Chapter 30, §50 . Related policies on billing and coding of claims, as well as coverage determinations, are found elsewhere in the CMS manual system or CMS website . On the billing side is a modifier we need to submit with the initial claim to signify the ABN is on file and the patient will then be responsible for the balance - GA Waiver of Liability Statement Issued as Required by Payer Policy, Individual Case Report when you issue a mandatory ABN for a service as required and it is on file. You do not need to submit a copy of the ABN, but you must have it available on request. The –GA modifier is used when both covered and noncovered services appear on an ABN-related claim. Read the full list of guidelines on the CMS website.  Some states are already making changes to Telehealth coverage. See the new announcement for the State of Florida. The Administration is taking aggressive actions and exercising regulatory flexibilities to help healthcare providers contain the spread of 2019 Novel Coronavirus Disease (COVID-19). CMS is empowered to take proactive steps through 1135 waivers as well as, where applicable, authority granted under section 1812(f) of the Social Security Act (the Act) and rapidly expand the Administration’s aggressive efforts against COVID-19. As a result, the following blanket waivers are in effect, with a retroactive effective date of March 1, 2020 through the end of the emergency declaration. From CMS - EXPANSION OF TELEHEALTH WITH 1135 WAIVER: Under this new waiver, Medicare can pay for office, hospital, and other visits furnished via telehealth across the country and including in patient’s places of residence starting March 6, 2020. A range of providers, such as... Continue reading on CMS In March of 2020, a long list of waivers were put into effect to help providers contain the spread of COVID-19. These waivers have been in effect since then with 90-day extensions granted now multiple times to cover the time we are still dealing with the effects of the virus. The next one is set to expire on July 19th. Several of these waivers made the way to have Telehealth be a viable option to provide treatment to patients remotely. Some agencies have advocated for a permanent expansion of Telehealth access after COVID-19 and will the individual insurances follow suit? I have been asked a lot lately if the extensions will expire this next expiration date. That is hard to predict and we can only stay tuned and watch for announcement are made. Remember, each insurance has their own interpretation and guidelines that they are following and we will have to see what they do. Below are some of the most common payers and their links to the COVID-19 guidelines. We are often asked to be able to "quote" what the benefits will be for a patient's insurance coverage prior to treatment with a provider. That process has changed dramatically over the years and it is now almost impossible to pin down. Insurance cards sometimes list an office copay benefit but that would only apply to a regular physician's office visit and not any type of specialty, like Psych. On-line access to benefits is an option for some insurances and will usually spell out the regular coverage. Some require a username and password to be set up to be able to go on-line and those also expire every 90-days or so and have to be kept in a secure location for HIPAA requirements. We actually have devoted entire shared, secured documents to just the handling of on-line usernames and passwords.

What does your "pie chart" look like in your practice?

I have used the same practice management software for over 15 years now and one reason I have continued with the same product is the amazing analytics that they provide in the reports module. I can send reports to my providers, daily, weekly or monthly or for any time frame they want and show the details of their practice financials. These reports are to help in seeing their medical practice as the business that it is and to be able to continually monitor the statistics. There are charge breakdown reports to show which CPT codes are used and those can also be further broken down by locations and insurance. Reports to show where the payments are coming from, which adjustments are made and rendering provider reports that are also sent to CPA's for payroll purposes. It could be anything you could think of that can and should be measured. As a medical billing/management company, we are given the task to follow up with insurance companies to get the claims paid for any charges turned in to us. Some insurances - like Medicare - make that task easy by having strict regulations in place that we follow and, by doing so, they pay easily and on time. Others will loosely follow guidelines and hold or even deny the same claims, and we are forced to contact them to get that claim paid. Find out how we help get those claims paid.

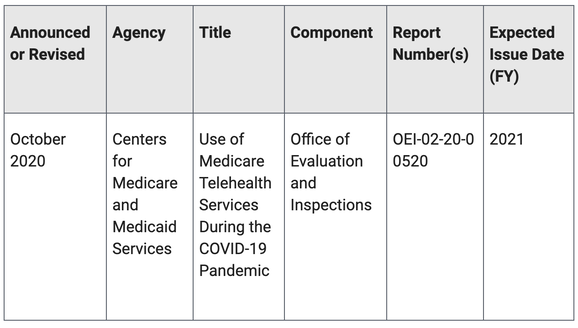

In response to the COVID-19 pandemic, the Centers for Medicare & Medicaid Services (CMS) made a number of changes that allowed Medicare beneficiaries to access a wider range of telehealth services without having to travel to a health care facility. CMS is proposing to make some of these changes permanent.

This review will be based on Medicare Parts B and C data, and will look at the use of telehealth services in Medicare during the COVID-19 pandemic. It will look at the extent to which telehealth services are being used by Medicare beneficiaries, how the use of these services compares to the use of the same services delivered in-person, and the different types of providers and beneficiaries using telehealth services. |

Categories

All

Archives

January 2023

|

|

© COPYRIGHT 2021. ALL RIGHTS RESERVED.

Privacy Policy Terms of Service |